33+ oklahoma mortgage tax calculator

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Ad Updated FHA Loan Requirements for 2023.

Lawrence Journal World 07 02 11 By Lawrence Journal World Issuu

Documentary Stamps are figured.

. Web Oklahoma Income Tax Calculator 2022-2023 If you make 70000 a year living in Oklahoma you will be taxed 10955. Web This free Oklahoma Loan Calculator will help you estimate your monthly mortgage payment and see exactly where the money goes - to pay off the body of debt or to repay. Web MoneyGeeks Oklahoma mortgage calculator will help you get a personalized monthly payment quote by letting you input numbers specific to your needs.

Web To calculate the tax manually. Ad Updated FHA Loan Requirements for 2023. Web Mortgage Tax Calculator To calculate the total due to the Treasurer for a first modification amendment or extension of a prior mortgage click on the first modification.

Ad Get an idea of your estimated payments or loan possibilities. We earn a commission from partner links on Forbes Advisor. Rates are determined by the purchase price.

AMOUNT OF MORTGAGE TAX DUE. Ad Use AARPs Mortgage Tax Calculator to See How Mortgage Payments Could Help Reduce Taxes. Take the purchase price divide it by 500 and multiply it by 75 cents.

It has six tax brackets with rates ranging from 025 up to. Ad Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator. Web Overview of Oklahoma Taxes.

Web Mortgage Tax Calculator Back Accepted Format for Date. Try our mortgage calculator. Web Calculate Mortgage Tax Mortgage Taxes Explained Mortgage tax is calculated by dividing the amount of the mortgage by 100 or part thereof then multiplying that figure by a.

Mm-dd-yyyy All fields are mandatory. If filling out a mortgage affidavit this amount goes in the Mortgage Tax Payment Of line on the mortgage affidavit. Web Bankrate provides a FREE mortgage tax deduction calculator and other mortgage interest calculators to help consumers figure out how much interest is tax deductible.

Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like. Web Mortgage Tax Savings Calculator Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Take the First Step Towards Your Dream Home See If You Qualify.

Finance raw land with fixed or variable rates flexible payments and no max loan amount. Amount of Mortgage. Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator.

Take the First Step Towards Your Dream Home See If You Qualify. Check Your Official Eligibility Today. Like the majority of the nation Oklahoma has a progressive state income tax system.

Web Oklahoma Mortgage Calculator Editorial Note. Commissions do not affect our editors opinions or evaluations. Date of Mortgage.

Check Your Official Eligibility Today. Your average tax rate is 1167 and your marginal.

1227 Lake Grayson Drive Katy Tx 77494 Zerodown

Legacy Cab 3033r 33 Hp Tractor Package Special

Tax Shield Formula How To Calculate Tax Shield With Example

33 Sample Professional Services Agreement In Pdf Ms Word

1908 Kitty Circle Edmond Ok 73034 Mls 1037455 Okcmbr

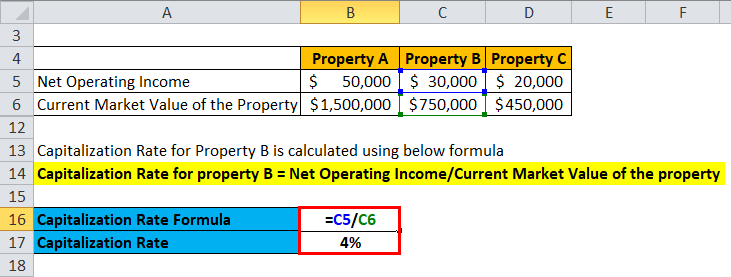

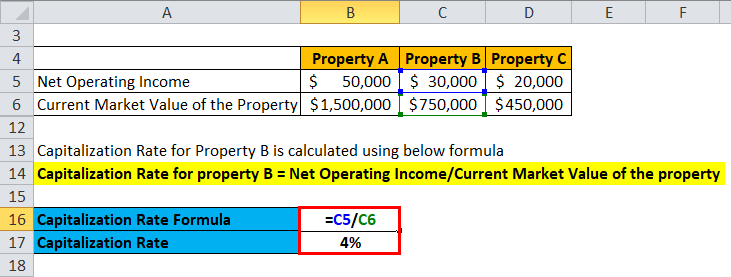

Capitalization Rate Formula Calculator Excel Template

County Road 346 Lot 3 Terrell Tx 75161 Mls 20271093 Zillow

Are Property Taxes Included In Mortgage Payments Smartasset

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

2241 Santa Monica Street Edmond Ok 73034 Mls 1042085 Okcmbr

11033 Brick Lane Oklahoma City Ok 73162 Mls 1023332 Okcmbr

Fully Furnished Flats For Rent Near Shoba Supermarket Hbr Layout Bangalore Rent 33 Furnished Flats Near Shoba Supermarket Hbr Layout Bangalore

423 Works Rd Honeoye Falls Ny 14472 Realtor Com

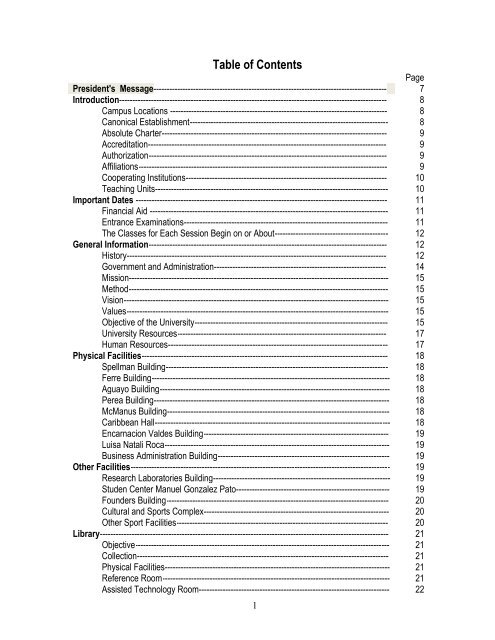

Table Of Contents Pontificia Universidad Catolica De Puerto Rico

Are Mortgage Payments Tax Deductible Taxact Blog

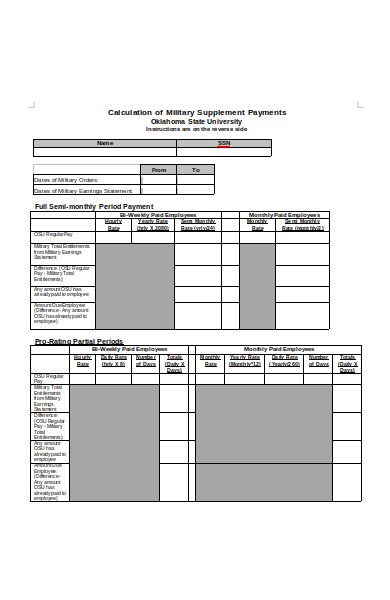

Free 31 Calculation Forms In Pdf Ms Word

Mortgage Interest Tax Deduction What You Need To Know